Updated: February 7, 2025

A key incentive driving its growth in renewable energy in 2025 is the Domestic Content Bonus Credit (DCBC), established under the Inflation Reduction Act of 2022 (IRA). The Domestic Content Bonus Credit incentivizes the use of American-made materials in renewable energy projects. By offering an additional tax credit for projects that meet specific domestic content requirements, the DCBC aims to stimulate U.S. manufacturing, create jobs, and strengthen the country’s renewable energy infrastructure.

This article provides an overview of the Domestic Content Bonus Credit, how it impacts commercial solar energy projects, and the progression of regulatory updates, including notices such as Notice 2023-38, Notice 2024-41, and Notice 2025-8, which will further shape the credit’s application and guidance.

What is the Domestic Content Bonus Credit (DCBC)?

The Domestic Content Bonus Credit is an add-on to existing federal tax credits for renewable energy projects such as solar, wind, geothermal, and battery storage. The credit offers a 10% bonus to projects that use domestically sourced materials for the construction and installation of renewable energy systems.

For projects claiming the Section 48E Investment Tax Credit (ITC), it typically offers a 30% ITC. With the added Domestic Content Bonus Credit of 10%, the credit (or IRS Elective Payment for qualifying tax-exempt organizations) is increased to 40%. If the project is claiming the 45X Production Tax Credit (PTC), it can receive an additional 10% of the project’s total cost if it meets the domestic content requirements.

The bonus credit incentivizes projects to support US manufacturing, strengthening American energy resiliency.

How Does the DCBC Apply to Solar and Renewable Energy Projects?

The Domestic Content Bonus Credit applies to commercial solar projects and other renewable energy projects of any scale. Battery storage projects are also eligible, although they add significant complexities to the process with current US supplies. It is also commonly applied to geothermal projects, where domestic content is more readily available.

To qualify for the Domestic Content Bonus, the project must meet certain criteria related to the percentage of the project’s materials that are sourced from domestic manufacturers.

To meet the Domestic Content Requirements projects must:

- Steel and Iron – 100% of steel and iron

- Manufactured Products – Based on year as calculated by IRS methodology

- Projects commencing in 2024 – 40%

- Projects commencing in 2025 – 45%

- Projects commencing in 2026 – 50%

- Projects commencing in 2027 – 55%

The guidelines for determining which materials count as “domestic” have evolved as the Treasury and the IRS have issued updated notices that provide more clarity and precision on the requirements. These updates aim to ensure that the domestic content standards reflect the growing capabilities of U.S. manufacturing and continue to align with the broader goals of the IRA.

Notice 2023-38: Initial Guidance

In Notice 2023-38, published to the Federal Register on June 21, 2023, the IRS and Treasury Department issued initial guidance that defined how projects could meet the Domestic Content Bonus Credit eligibility. The guidance laid out the framework for determining whether a project qualified, particularly for large-scale projects, and set forth rules for sourcing materials and components used in renewable energy projects.

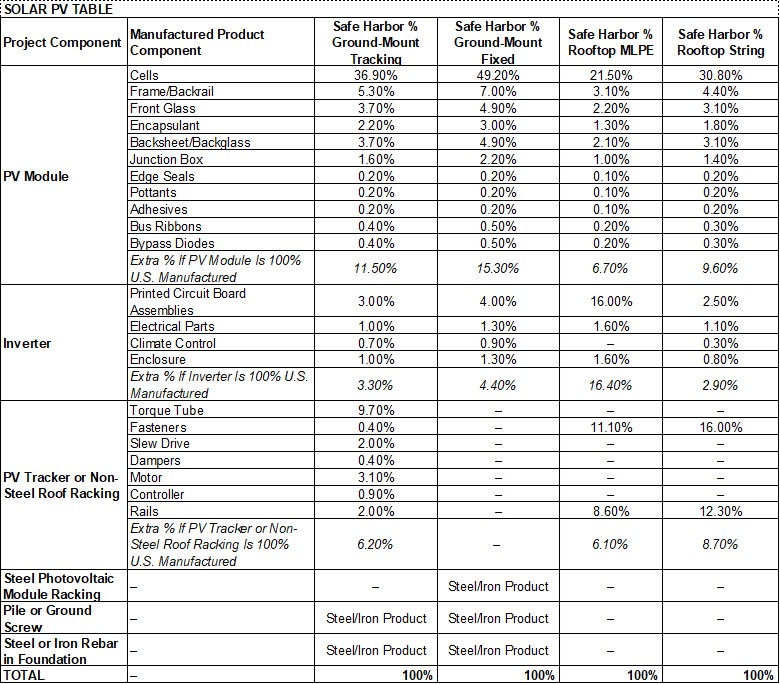

Notably, Notice 2023-38 introduced the concept of safe harbor tables, which provided detailed lists of materials and their respective percentages of domestic content. These tables were key in guiding developers and manufacturers on how to meet the credit’s requirements, outlining what components counted toward the 10% bonus and setting a benchmark for the percentage of U.S.-made materials required.

The key takeaway from this notice was the establishment of the foundational framework for the DCBC, but it was understood that additional clarification would be needed as the program evolved, especially regarding the exact mechanics of how domestic content could be documented and tracked.

Notice 2024-41: Current Guidance

Notice 2024-41 was published to the Federal Register on July 11, 2024. This notice introduced updates to the safe harbor tables introduced in 2023. It offered more precision in the classification of materials and components, with a stronger emphasis on the percentage of each component that must come from U.S. sources to qualify for the bonus credit.

Additionally, Notice 2024-41 also addressed issues of compliance, providing a more streamlined process for reporting domestic content in renewable energy projects. It set clearer expectations on how projects could document compliance, making it easier for developers and contractors to prove that they were meeting the minimum thresholds of domestic content.

Table 1: Solar PV Safe Harbor Percentages Based on Notice 2024-41

Notice 2025-8: New Guidance for 2025

Notice 2025-8, which was published by the Department of Treasury on January 16, 2025, has not yet officially been published in the Federal Register as of the date of this publication. With the signing of many Executive Orders in the wave of Presidential action, these guidelines remain delayed from publishing. It will only become fully actionable once published in the Federal Register and is subject to any additional reviews mandated by Executive Orders.

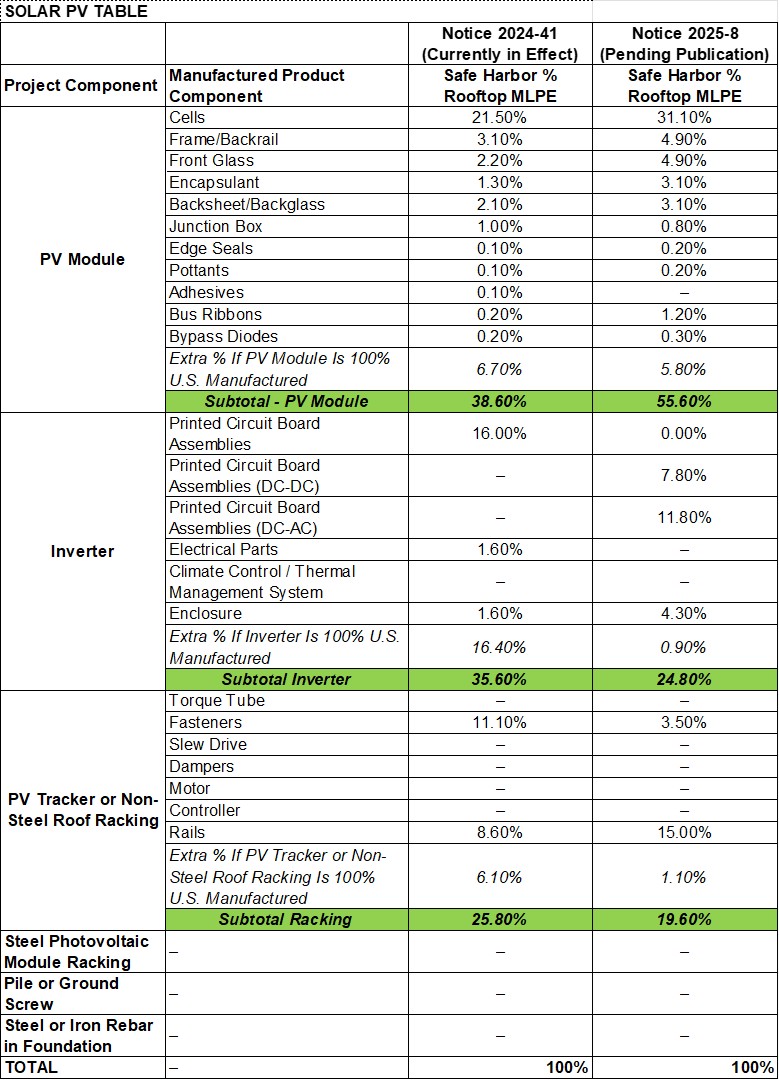

Once published, Notice 2025-8 will have major changes to the safe harbor calculations for solar projects and, when coupled with current market availability of domestically manufactured components, will likely limit the ability of many projects to claim the domestic content bonus credit.

With projects beginning in 2025 needing to reach a 45% threshold of domestic content, coupled with revised tables in Notice 2025-8 that put more emphasis on panels (and thus less emphasis on inverters, racking, and tracking equipment), it will be difficult for projects that planned to qualify through non-panel components to reach the critical threshold level.

Once Notice 2025-8 is published and in effect, it is increasingly unlikely that projects can qualify under safe harbor rules without selecting panels that are at least partially compliant with domestic content manufacturing. With a limited (but increasing) supply of PV panels that include American-made cells or other components, components from compliant manufacturers, such as Heliene, Suniva, and ES Foundry be in high demand.

See Table 2 below for a comparison of a typical Commercial Solar Rooftop Module-Level Power Electronics (MLPE) Project, a common project type of many commercial rooftop installations.

Table 2: Comparison of Rooftop MLPE Safe Harbor Tables (2024-41 vs. 2025-8)

What Happens for Projects in Progress?

As developers and organizations await the official publication of Notice 2025-8 in the Federal Register, it’s important to note that Notice 2024-41 remains in effect for projects that are already in progress or in the planning stages.

Once published, Notice 2025-8 will be in effect for future projects. However, Notice 2025-8 introduces a transition period of 90 days from the date of official publication. During this period, projects that commence construction can choose either to follow the guidance set out in Notice 2024-41 or Notice 2025-8, whichever is more beneficial or applicable. After the 90-day transition period, all projects will be subject to compliance with the updated guidelines.

Next Steps for Stakeholders

For stakeholders who are in the midst of planning or developing renewable energy projects, it is crucial to stay updated on the final publication of Notice 2025-8 in the Federal Register. Until then, Notice 2024-41 remains the guiding document, but developers and businesses should be prepared for the potential changes once 2025-8 becomes official.

Work with a trusted advisor to navigate the nuances of regulatory changes and documentation requirements. If you’d like to explore with Regenerative Shift, Contact Us!

_______________________________________________________________________________________________________________________________

About the Author

Caleb Quaid is the founder of Regenerative Shift, a Tampa-based environmental consulting firm, working with businesses and communities on regenerative environmental initiatives and sustainability programs. Regenerative Shift focuses on life-creating and cost-saving holistic programs, including regenerative land and water projects and Inflation Reduction Act (IRA) consulting. As a consultant and public speaker, Caleb provides motivating insight into practical life-creating environmental practices and shows the business case for going green with tax incentives under the IRA.

Now what?

The IRA can be a lot to navigate, and new guidance is issued every week. If you’d like to discuss how your business can benefit, Regenerative Shift is here to help! Contact Us!