48C Key Points Summary

- The Inflation Reduction Act (IRA) Section 48C provides $10 billion in funding for advanced energy projects, including solar, wind, electric vehicles, green infrastructure, critical materials, and carbon capture technologies.

- Upgrades in energy-intensive sectors like cement, iron, steel, aluminum, and chemical manufacturing to reduce greenhouse gas emissions are also eligible for funding.

- The Department of Energy (DOE) announced $4 billion in tax credit allocations on March 28, 2024 under the Round 1 funding process.

- DOE announced that 48C Round 2 funding of the final $6 billion will have an application window that closes on June 21, 2024.

- To be eligible for the credit, the Department of Energy must recommend the project through a competitive review process.

- The 48C process involves submitting a Concept Paper and an application that tailor your project to DOE strategic priorities around job creation, GHG emissions reduction, innovation, and supporting US supply chains.

- There are three categories of eligible projects: Clean Energy Manufacturing and Recycling, Greenhouse Gas Emissions Reduction, and Critical Materials.

- Each category has specific criteria for evaluation, including commercial viability, greenhouse gas emissions impacts, strengthening US supply chains, and workforce/community engagement.

- Energy Communities Census tracts will receive specific funds, with $1.5 billion allocated in Round 1 and expected to be at least $2.5 billion of the remaining funding in Round 2.

Links to Official Program Sites

Department of Energy – Qualifying Advanced Energy Project Credit (48C) Program

Department of Energy – 48C Program Announcement

IRS – Advanced Energy Project Credit

Section 48C: Advanced Energy Project Credit

Through the Inflation Reduction Act (IRA), $10 billion is allocated to investment tax credits under Section 48C for advanced energy projects. Each project is eligible for a 30% investment tax credit (subject to meeting certain prevailing wage and apprenticeship requirements) for project costs for tangible property, not including the building or its structural components.

Through subsequent guidance, most notably IRS Notice 2023-44 on May 31, 2023, advanced energy projects fit into one of three categories:

- Clean Energy Manufacturing and Recycling Projects (9 Subcategories)

- Greenhouse Gas Emissions Projects

- Critical Materials Projects

To be eligible for tax credits, the project may not be placed in service prior to award allocation.

DOE evaluates and recommends projects based on four (4) technical review criteria:

- Commercial viability

- Greenhouse gas emissions impacts

- Strengthening US supply chains and domestic manufacturing for a net-zero economy

- Workforce and community engagement

Round 1 and Round 2 Program Timing and Process

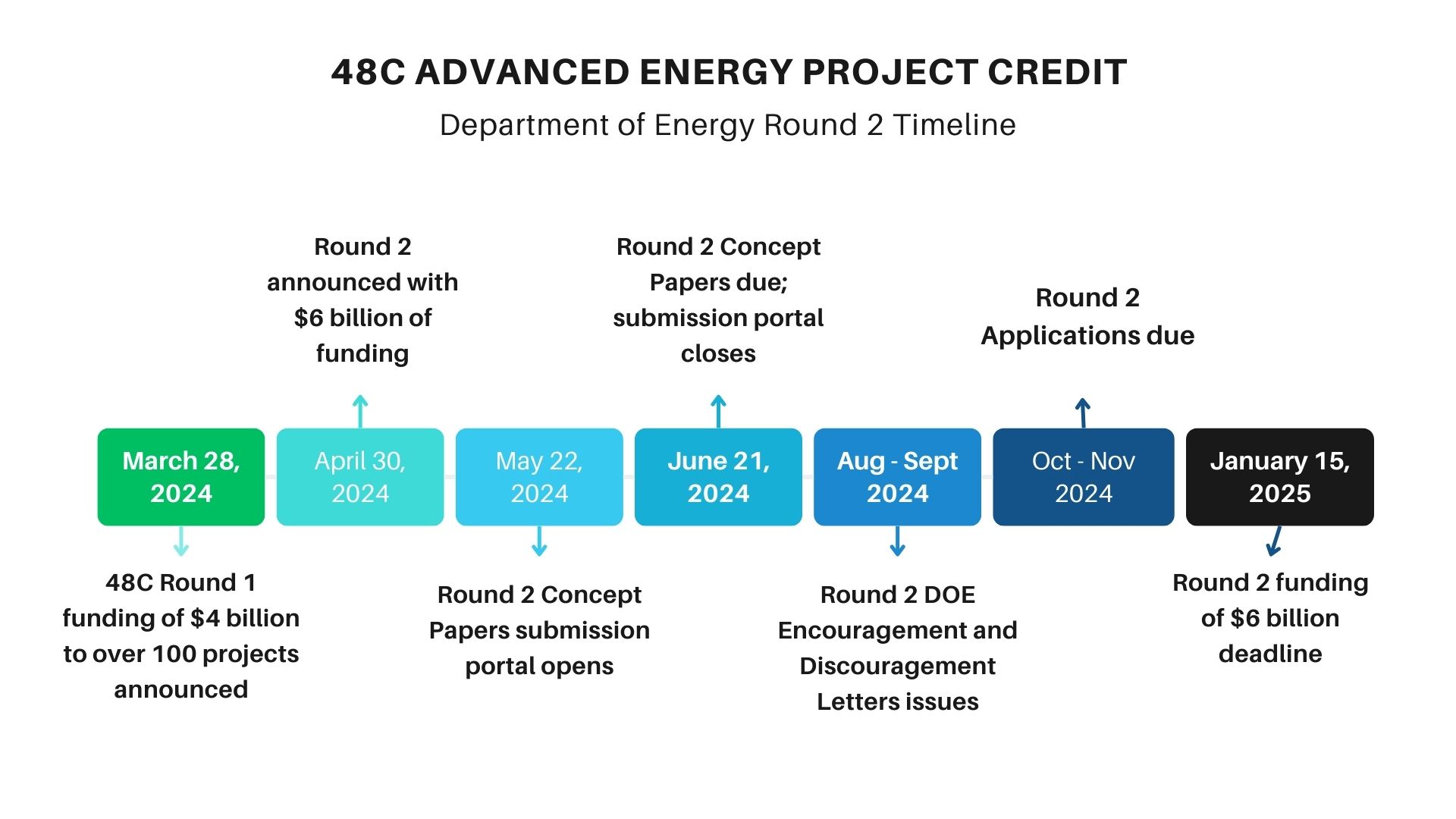

48C Round 1 Timeline and Round 2 Deadline 48C Round 2 Timeline[/caption]

48C Round 2 Timeline[/caption]

Round 1 of 48C allocated $4 billion in tax credits to over 100 projects across 35 states. Of the $4 billion awarded, $1.5 billion was in designated Energy Communities, slightly under the 40% target set by the DOE. Concept Papers (first round of submission) was due on July 31, 2023 and projects were ultimately awarded allocation on March 28, 2024.

48C Round 2 was announced by DOE as having a June 21, 2024 Concept Paper submission deadline, likely to follow a similar application and award cycle. Round 2 is announced as funding the remaining $6 billion, with at least $2.5 billion awarded to projects in Energy Community census tracts.

To apply for the credit is a multi-step process, with feedback from the Department of Energy (DOE) along the way.

Step 1: Concept Paper

Qualified applicants submit through the DOE 48C Portal a 5-page Concept Paper that outlines the project’s scope, anticipated benefits, and alignment with program objectives such as clean energy advancement, emissions reduction, and economic impact on designated energy communities. Round 2 will have a June 21, 2024 deadline to submit a project Concept Paper.

Step 2: DOE Encouragement or Discouragement

After review of the Concept Paper, DOE issues a letter of Encouragement or Discouragement as to it relates to your projects likelihood to receive award of the tax credit allocation compared to project requirements and other Concept Papers.

In Round 1, more than half of submitted Concept Papers were discouraged from application. Round 2 is expected to be similarly competitive, with projects receiving encouragement being closely aligned with DOE strategic goal scoring metrics.

Step 3: Application

Whether the DOE provides encouragement or discouragement for the concept paper, applicant may still complete the application, although projects that are discouraged from applying are less likely to be allocated funds. The application is a more detailed 30-page project plan that addresses feasibility and technical aspects of the project. The DOE will review each application and provide recommendations to the IRS regarding acceptance or rejection of each application. The IRS will approve projects for the tax credit and sends a letter of notification to the applicant.

In Round 1, $13.5 billion in applications from over 250 applicants resulted in $4 billion in funding to over 100 applications.

Step 4 and Beyond

Round 2 funding will be announced by the DOE no later than January 15, 2025.

After receiving an allocation of the credit from the IRS, the approved application (taxpayer) has two (2) years to notify DOE that the certification requirements have been met by submitting through the designated portal. The IRS issues a Certification Letter. Within two (2) years of receiving the Certification Letter, the taxpayer notifies DOE the project has been placed into service, and then can claim the 48C tax credit on that year’s return.

Categories of Eligible Projects

There is a host of eligible projects in three categories (and their subcategories).

Clean Energy Manufacturing and Recycling Projects (9 Subcategories)

A qualifying advanced energy project in this category re-equips, expands or establishes an industrial or manufacturing facility for the production or recycling of specified advanced energy property:

- Property designed to be used to manufacture products that produce energy from the sun, wind, or geothermal deposits.

- Examples: Solar panels, wind turbines, offshore wind platforms, geothermal turbines and heat pumps, components for solar, wind, and geothermal equipment

- Fuel cells, microturbines or energy storage systems and components

- Examples: stationary batteries, stationary hydrogen fuel cells, hydrogen storage vessels, microturbines for combined heat and power systems, and components.

- Electric grid modernization equipment

- Examples: power flow, control, and conversion, such as transformers, power electronics, advanced meters, breakers, switchgears and more.

- Carbon Capture Equipment

- Equipment that is necessary to compress, treat, process, liquify, pump, or perform some other physical action to capture carbon oxide emissions.

- Examples: solvents, membranes, chemical processing equipment, compressors, monitoring equipment, injection equipment, and more.

- Renewable, Low-Emission Fuel, Chemical or Product

- Examples: clean hydrogen, low-emission ammonia, renewable biofuels, basic organic chemicals, polymers and resins.

- Energy Conservation Technologies (including residential, commercial and industrial applications)

- Technologies that are eligible for residential or commercial efficiency improvements for purposes of the 25C tax credit or the 179D tax deduction, as well as equipment with direct net energy use reduction, such as ultra-efficient heat pumps, insulation, ultra-efficient hot water systems, sensors, and controls

- Electric Vehicles, Fuel Cell Vehicles, Components and Infrastructure

- Examples: Electric cars, trucks and buses, electric vehicle supply equipment, charging equipment, hydrogen refueling stations equipment, components of these systems

- Hybrid Vehicles over 14,000 lbs

- Examples: equipment and components for hybrid vehicles over 14,000 lbs

- Examples: equipment and components for hybrid vehicles over 14,000 lbs

Greenhouse Gas Emissions (GHS) Reduction Projects (5 Subcategories)

A qualifying advanced energy project in this category re-equips an industrial or manufacturing facility, including in energy-intensive manufacturing sections, such as cement, iron, steel, aluminum, chemicals and other sectors, with equipment to reduce greenhouse gas emissions by at least 20 percent through installation of one or more the following:

- Low-or zero-carbon process heat systems

- Examples: installation combined heat and power, thermal storage technologies, other heating systems based on electricity, clean hydrogen, biomass or waste heat recovery

- Carbon capture, transport, utilization and storage systems

- Examples: equipment necessary to compress, treat, process, liquify, pump or perform some other physical action that capture carbon oxides, along with the specialized equipment needed for transport and storage of carbon oxides.

- Energy efficiency and reduction in waste from industrial processes

- Examples: technologies that reduce direct fuel use, electricity use, or waste in industrial applications, such as heat pumps, combined heat and power systems, insulation, sensors, controls and smart energy management

- Any other industrial technology designed to reduce GHG emissions, as determined by the Secretary of Energy

Critical Materials

A qualifying advanced energy project in this category re-equips, expands or establishes an industrial facility for the processing, refining, or recycling of critical materials as defined by the Energy Act of 2020. For Round 1, critical materials consisted of:

- 2023 Final List of Critical Materials, including: the “electric eighteen” of aluminum, cobalt, copper, dysprosium, electrical steel, fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, silicon, silicon carbide and terbium.

- 2022 Critical Minerals List, including: aluminum, antimony, arsenic, barite, beryllium, bismuth, cerium, cesium, chromium, cobalt, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lithium, lutetium, magnesium, manganese, neodymium, nickel, niobium, palladium, platinum, praseodymium, rhodium, rubidium, ruthenium, samarium, scandium, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, vanadium, ytterbium, yttrium, zinc, and zirconium.

DOE Review Criteria

Each of the three project categories (with subcategories) has Concept Paper and Application requirements that are divided into four review criteria. Because of the competitiveness of 48C, with over 10 times the requested funding to funding available, it is critical for projects to ensure alignment with the DOE strategic goals.

- Commercial viability

- Identifying projects with the lowest levelized cost, shortest time frame for completion, lowest risk, and highest impact

- Greenhouse gas emissions impacts

- Identifying projects with the greatest net impacts in avoiding or reducing anthropogenic emissions of GHG

- Strengthening US supply chains and domestic manufacturing for a net-zero economy

- Identifying projects with the greatest impact on domestic job creation and potential for technological innovation and commercial deployment

- Workforce and community engagement

- Identifying projects with the workforce and community support that will lead to domestic job creation, reduce barriers that may otherwise increase project completion time, and have an impact on avoiding or reducing local pollution, including non-greenhouse gas air pollution.

Energy Communities Census Tracts

DOE will allocate at least 40% ($4 billion) to designated Energy Communities as published on by the IRS Energy Community Census Tract List. In Round 1, $1.5 billion was designated to Energy Communities, leaving at least $2.5 billion to be allocated to these communities in 48C Round 2.

Need Help?

48C Advanced Energy Project Credit is highly competitive but has potential to save your project millions of dollars in tax credits. If you want help to best position your project for success, we are here to help. Contact us!

Check out our 48C Consulting Services Page for more info.