Table of Contents

ToggleExecutive Summary (Key Takeaways)

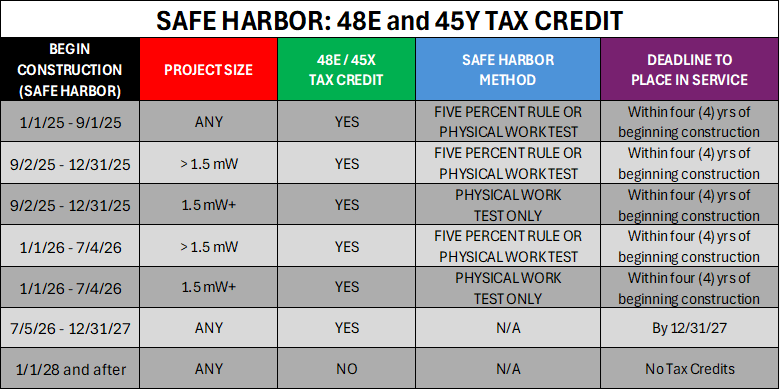

- In follow up to One Big Beautiful Bill Act (OBBBA) which dramatically rolled back timelines for claiming commercial Solar Tax Credits, and the White House Executive Order issued on July 7th, the IRS released Notice 2025-42 on August 16th, providing new guidance on Safe Harbor rules for purposes of tax credits.

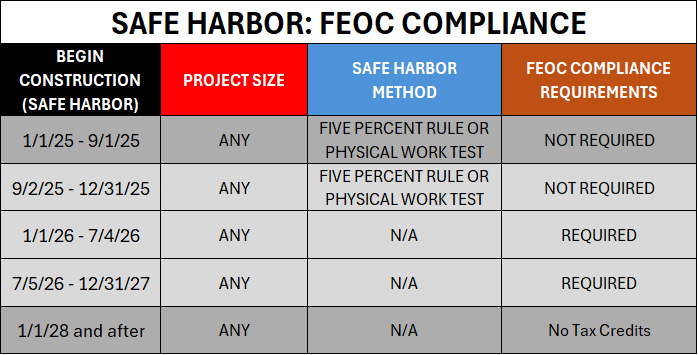

- OBBBA had two important Safe Harbor provisions: one related to whether the project could be placed in service after 12/31/27, and one related to FEOC Compliance Requirements. Notice 2025-42 only applies Safe Harbor related to claiming tax credits for projects placed in service after 12/31/25.

- FEOC compliance requirements remain unchanged by this notice. Safe Harbor for FEOC compliance is still governed by Notice 2013-29 and 2018-59 and subsequent related guidance.

- Because of FEOC Compliance Requirements beginning in 2026, most commercial solar projects will benefit from Safe Harboring their project in 2025, even if it will be placed in service by 12/31/27.

- Continuity rules remain. Developers must show continuous work or investment toward completion to keep Safe Harbor status.

- Projects finishing in 2028 or later lose eligibility. Projects that don’t meet Safe Harbor Guidelines under IRS Notice 2025-42 and are placed in service in 2028 or later will not receive Section 48E or 45Y tax credits.

- Action needed: Businesses, non-profits and municipalities should move quickly to begin projects in 2025 to ensure tax credits and avoid risk.

Background: OBBBA and Why Safe Harbor Matters

The One Big Beautiful Bill Act (H.R. 1, Public Law 119-21), signed July 4, 2025, dramatically rolled back timelines for solar credits. For commercial, industrial, and utility-scale solar projects, the Investment Tax Credit remains available via Section 48E (the tech-neutral clean electricity credit). However, the OBBBA introduced hard stop dates and requirements that didn’t exist before. Here are the key changes:

Placed-in-Service Deadline: For any solar projects that start construction after July 4, 2026, the law imposes a strict cutoff – they must be placed in service by December 31, 2027 to get a tax credit. This effectively means that no new solar projects can begin after mid-2026 and still expect federal tax credits unless they are completed in 2027 or earlier.

Beginning of Construction Deadline: For projects that meet the Safe Harbor requirements to begin construction by July 4, 2026, the December 31, 2027, placed in service deadline doesn’t apply. Instead, these projects have up to four (4) years from when they begin construction to be placed in service. This is mostly relevant only to large-scale, complex solar projects, such as utility solar farms, as the development timeline for most rooftop and ground mount commercial projects is typically one year or less.

Safe Harbor rules are what allow projects started before certain deadlines to still claim tax credits, even if finished later. For solar companies, schools, businesses, and municipalities, Safe Harbor can mean the difference between a 30% tax credit and no credit at all.

Two “Safe Harbor” Requirements Under OBBBA

OBBBA included two distinct Safe Harbor Requirements for different provisions of the legislation. Notice 2025-42 applies online to requirements related to the Placed In service Deadline:

Safe Harbor for Placed In Service Deadline

In OBBBA, commercial solar projects that begin on or after July 5, 2026, must be placed in service by December 31, 2027, to receive the Section 48E or 45Y tax credits. Projects placed in service in 2028 and after are not eligible for these tax credits (most notably the 48E 30% Investment Tax Credit). Notice 2025-42 specifically provides guidance on the rules to Safe Harbor the beginning of construction prior to July 5, 2025 for purposes of not being subject to the December 31, 2027 placed in service deadline.

Safe Harbor for FEOC Compliance Requirements

In order to be eligible for either Section 48E or 45Y, all projects that begin construction on or after January 1, 2026, must meet Foreign Entity of Concern (FEOC) Compliance Requirements, most notably for commercial solar projects is the Material Assistance Requirements.

OBBBA specifically noted in its legislation that longstanding Safe Harbor provisions under IRS Notice 2013-29 and IRS Notice 2018-59 are how beginning of construction is determined for purposes of FEOC Compliance Requirements. Projects that meet either the Five Percent Safe Harbor Rule or the Physical Work Test to Safe Harbor their project by December 31, 2025, are exempt from the FEOC Compliance Requirements mentioned in OBBBA. For any project that is expected to be placed in service prior to December 31, 2027, this is the more important deadline to be aware of.

Safe Harbor Options for Solar

Longstanding guidance under IRS Notices 2013-29 and 2018-59 established two “tests” for beginning construction. Under these guidelines, a construction project can Safe Harbor as beginning construction by passing either the Five Percent Safe Harbor Rule or the Physical Work Test. Additionally, once a project has begun construction, there are Continuity Requirements that the project continue work towards completion.

1. Five Percent Safe Harbor Rule

Most common and typically the easiest to document is the Five Percent Safe Harbor Rule. Simply put, have a binding contract and make a payment that totals at least five percent of the total final construction costs, and the project is deemed to have begun construction as of the date of that payment.

Example: A solar project client that has a total project cost of $2,000,000 enters into a binding contract and makes a $100,000 payment on August 20, 2025 is deemed to have begun construction as of the date of that payment.

NOTE: The Five Percent Safe Harbor Rule requires that the initial payment be 5% or greater of the final total project cost, so if in the example above the final project costs exceed $2,000,000, the project would no longer be qualified for Safe Harbor by the payment it made. It is always advised that contractors and developers pay more than 5% (i.e. 7.5% or 10%) to avoid any possible ineligibility issues down the line.

2. Physical Work Test

Safe Harbor can also be established by starting physical work of a “significant nature” in 2025. This includes site grading, racking installation, or other tangible work (not just permitting or design). This test is typically passed later in the development timeline than the Five Percent Safe Harbor Rule, and thus is not commonly relied upon for Safe Harbor for most current commercial projects.

3. Continuity Requirement

Once Safe Harbor is established, progress must be steady. Developers can meet this either through continuous construction or continuous efforts (purchases, contracts, etc.), and documentation of the Continuity of the project.

How IRS Notice 2025-42 Changes Safe Harbor Rules

IRS Notice 2025-42 was issued on August 16, 2025 and updated the Safe Harbor Rules for beginning construction on solar and wind projects as it related to placed in service deadlines under OBBBA for Section 48E and Section 45Y tax credits.

Projects under 1.5mW had no substantial changes to Safe Harbor Rules. These projects are eligible to use the Five Percent Safe Harbor Rule or the Physical Work Test to Safe Harbor a project prior to July 5, 2026 and have additional time to place in service beyond December 31, 2027.

Larger projects, those 1.5mW and larger, must satisfy the Physical Work Test for any project that begins on September 2, 2025 or later and are no longer eligible for the often easier Five Percent Safe Harbor Rule.

Notice 2025-42 also updated the Continuity Requirement rules, making continuous progress milestones more important to document for compliance.

Safe Harbor to Avoid FEOC Compliance Requirements – December 31, 2025

OBBBA introduced Foreign Entity of Concern (FEOC) Compliance Requirements. In order for solar projects to qualify for Section 48E or 45Y tax credits, any project that begins after December 31, 2025 must meet and document FEOC Compliance Requirements, most notable the “Material Assistance from Prohibited Foreign Entity” Requirements. OBBBA outlined significant guidance on FEOC Compliance, but much is still unclear.

Beginning in 2026, it may be difficult to find solar panels and products that meet FEOC requirements. Thus, it may be difficult to have projects qualify for the 30% Section 48E tax credit while US manufacturing and supply chains catch up with the new rules.

IRS Notice 2025-42 did not change the rules for Safe Harbor for FEOC in OBBBA, and in a footnote explicitly state that “the guidance in this notice is not intended to address beginning of construction rules for the purposes of those foreign entity restrictions. The Treasury Department and the IRS are currently drafting additional guidance as is necessary and appropriate to implement those restrictions, as enacted by the OBBBA.”

As it stands, projects of any size (including those over 1.5 mW) can Safe Harbor under the Five Percent Safe Harbor Rule on or before December 31, 2025 and be exempt from meeting FEOC Compliance Requirements to qualify for the Section 48E and 45Y tax credits. For most projects, this Safe Harbor deadline is critically important to avoiding tax credit risk.

Safe Harbor Examples: How This Works

Example 1: Large Project, Started in 2025/26, Completed in 2027

Project Size: 2.0 mW

Five Percent Safe Harbor Rule Date: October 1, 2025

Physical Work Test Date: August 1, 2026

Placed In Service Date: October 1, 2027

Because this project is 1.5 mW or larger, it’s Safe Harbor method for Placed In Service Deadlines is tied to the Physical Work Test, which was in August 2026. However, because it met the Five Percent Safe Harbor Rule prior to December 31, 2025, it is exempt from FEOC Compliance Requirements. It is placed in service before December 31, 2027, so it is eligible for the Section 48E or 45Y tax credits.

Example 2: Large Project, Started in 2025/26, Completed in 2028

Project Size: 2.0 mW

Five Percent Safe Harbor Rule Date: October 1, 2025

Physical Work Test Date: August 1, 2026

Placed In Service Date: October 1, 2028

Because this project is 1.5 mW or larger, it’s Safe Harbor method for Placed In Service Deadlines is tied to the Physical Work Test, which was in August 2026. Because the project is placed in service after December 31, 2028, it is eligible for the Section 48E or 45Y tax credits.

Example 3: Small Project, Started in 2026, Completed in 2028

Project Size: 500 kW

Five Percent Safe Harbor Rule Date: February 1, 2026

Physical Work Test Date: August 1, 2026

Placed In Service Date: October 1, 2028

Because this project is under 1.5 mW, it is Safe Harbored with the Five Percent Safe Harbor Rule, which is February 2026. Even though this project is placed in service after December 31, 2027, it is eligible for the Section 48E or 45Y tax credits. However, because construction began after December 31, 2025, this project must meet FEOC Compliance Requirements to receive the tax credits.

What Business Owners and Solar Companies Should Do

- Move quickly: Projects started in 2025 have the easiest pathway towards tax credits. FEOC Compliance begins in 2026 and the tax credits terminate at the end of 2027.

- Budget carefully: Secure at least 5% of final total project costs this year to lock in Safe Harbor under the Five Percent Safe Harbor Rule.

- Document everything: Keep contracts, invoices, and construction records to prove compliance.

- Consult experts: IRS rules are complex and shifting — professional guidance can protect your investment.

Conclusion

If you’re planning a commercial project, now is the time to act. Work with experienced consultants like Regenerative Shift to navigate the rules, protect your investment, and ensure your solar project captures the credits you’re counting on.