Table of Contents

Toggle

How businesses, nonprofits, and contractors can maximize tax deductions for energy-efficient buildings before 2026.

Executive Summary

- Section 179D provides up to $5.81 per square foot (for 2025 projects) in tax deductions for energy-efficient commercial and public buildings.

- Under the One Big, Beautiful Bill Act (OBBBA), projects must begin construction by June 30, 2026 to qualify for 179D.

- To use the easier ASHRAE 90.1-2007 baseline, projects must be placed in service by December 31, 2026.

- Projects placed in service after 2026 must use ASHRAE 90.1-2019, which is far stricter.

- Inflation adjustments increase the deduction value each year.

- Nonprofits and governments can allocate the deduction to eligible designers, creating big opportunities for architects and contractors.

- Time is short—many projects placed in service by end of 2026 could qualify under the 2007 baseline, but only if they begin construction by June 30, 2026.

“Up to $5.81 per square foot available in 2025.”

What is Section 179D?

Section 179D, the Energy Efficient Commercial Buildings Deduction, was created through the Energy Policy Act of 2005 to encourage energy-saving upgrades and sustainable building practices for commercial buildings. It rewards building owners—or designers in the case of nonprofits and governments—for making choices that reduce energy use.

The deduction can be as much as $5.00 per square foot (increased with annual inflation adjustments) if certain requirements are met. For large buildings, that translates into millions of dollars of tax deductions that can help finance energy-efficient projects.

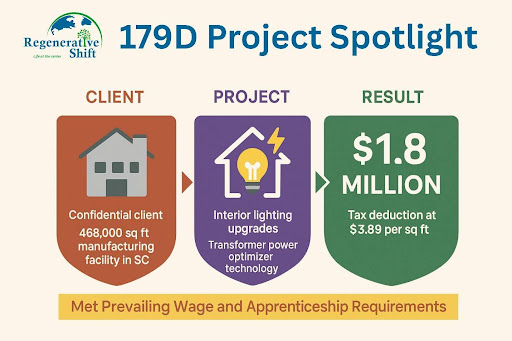

Example:

In 2025, Regenerative Shift supported a confidential client with a 468,000-square-foot manufacturing facility in South Carolina. By implementing energy-efficient lighting and transformer power optimizers, the project secured a $1.8 million deduction, at $3.89 per square foot, by meeting energy savings and compliance requirements.

What Types of Projects Qualify Under Section 179D?

Section 179D rewards energy-efficient improvements made to commercial buildings. To qualify, projects must demonstrate energy savings in at least one of three core building systems:

Building Envelope

- Includes insulation, roofing, windows, walls, and doors.

- Projects that reduce heating and cooling demand by improving the thermal boundary of the building can qualify.

- Example: Installing high-efficiency roofing materials that better insulate the building.

Interior Lighting Systems

- Upgrades to efficient lighting systems are one of the most common ways to qualify.

- With the ASHRAE 2007 baseline (still in effect until December 31, 2026), LED lighting is not required, meaning nearly any project with LED retrofits typically qualifies.

- Example: A manufacturing facility that replaces fluorescent fixtures with LEDs and uses advanced lighting controls.

HVAC and Hot Water Systems

- Projects that replace or upgrade heating, ventilation, air conditioning, or hot water systems can qualify.

- These systems must achieve measurable reductions in energy use compared to baseline code requirements.

- Example: Replacing an outdated chiller with a high-efficiency system or adding energy recovery ventilation.

Process for Qualifying a 179D Deduction

Qualifying for the 179D deduction is not automatic—it requires a structured process with specific steps and documentation.

- Energy Modeling

- An independent third-party (often an engineer) conducts IRS-compliant energy modeling using Department of Energy–approved software.

- The model compares the energy performance of the building with the applicable ASHRAE standard (2007 or 2019 depending on service date).

- This establishes whether the project meets the efficiency thresholds for the deduction.

- On-Site Inspection

- A qualified professional performs a physical inspection to confirm that the installed systems match the modeled design.

- This ensures compliance and accuracy of the claim.

- Prevailing Wage and Apprenticeship (PWA) Requirements

- To qualify for the maximum deduction (up to $5.00 per square foot in 2025, adjusted annually for inflation), projects must comply with prevailing wage and apprenticeship standards set by the IRS and Department of Labor.

- Contractors must document labor hours, wages, and apprentices employed during the project.

- Allocation for Nonprofits and Municipalities

- Since schools, universities, governments, and nonprofits don’t pay federal taxes, they can allocate the deduction to eligible designers (architects, engineers, contractors).

- This requires a formal allocation letter from the tax-exempt entity to the designer, making 179D a unique incentive that benefits both the owner and the design team.

By following this process and ensuring proper documentation, building owners and contractors can capture significant tax savings while improving the performance and value of their buildings.

Inflation Adjustments

One of the less visible but important aspects of 179D is the inflation adjustment. The maximum per-square-foot deduction isn’t static. Each year, the IRS adjusts the deduction to reflect inflation.

This means that the value of deductions grows over time, even as energy efficiency codes become more stringent. For example, the top-line $5.00 per square foot is not a fixed cap but one that can rise slightly with each IRS update. For large projects, even a few extra cents per square foot add up quickly.

For projects placed in service in 2025, the maximum deduction is $5.81 per square foot, after inflation adjustment. It is expected that the 2026 inflation adjustment will further increase the value of the deduction for applicable projects.

OBBBA Changes 179D Timeline

The One Big, Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, imposed hard cutoffs for many clean energy incentives, including Section 179D.

Here’s what changed:

- Projects must begin construction by June 30, 2026 to qualify for 179D. Any project starting after this date won’t be eligible.

- Projects placed in service by December 31, 2026 will be evaluated against ASHRAE 90.1-2007, an easier standard to meet.

- Projects placed in service after 2026 will be measured against ASHRAE 90.1-2019, a much stricter benchmark.

This means the clock is ticking. Projects need to start soon and finish by the end of 2026 to get the maximum benefit.

Why ASHRAE 90.1 Versions Matter

ASHRAE 90.1 is the national energy code standard used to evaluate projects under 179D. The version of the code you’re compared against determines how hard it is to qualify.

- ASHRAE 90.1-2007: Much less stringent. Crucially, LED lighting is not part of the baseline in 2007, meaning simply installing LED lighting qualifies as a major efficiency improvement.

- ASHRAE 90.1-2019: Far stricter, with LED lighting assumed as standard. HVAC, insulation, and other technologies must reach significantly higher thresholds to qualify.

Why this matters:

Most commercial new buildings and major retrofit projects placed in service by December 31, 2026 will likely qualify for 179D, because LED lighting alone creates substantial efficiency gains compared to the 2007 baseline. After 2026, those “easy wins” are gone.

PWA Requirements

To qualify for the full $5.00 per square foot deduction (plus inflation adjustment), projects must comply with prevailing wage and apprenticeship (PWA) requirements.

- Prevailing Wage: Workers on the project must be paid at or above prevailing wage rates for their trade and location.

- Apprenticeships: A certain percentage of labor hours must be performed by qualified apprentices.

80% of the value of the deduction is tied to meeting PWA Requirements. Without PWA compliance, deductions will max out at $1.00 per square foot ($1.13/sf for 2025 projects after inflation adjustment). It is critical for any project looking to claim 179D that they work on the front end with contractors to ensure compliance with Prevailing Wage and Apprenticeship Requirements.

Allocation Letters for Nonprofits and Governments

One unique aspect of 179D is that nonprofits and government entities—which don’t pay federal income taxes—can allocate the deduction to the designers or design-build contractors who implemented the efficiency improvements.

This is done through an allocation letter, which:

- Identifies the building owner (nonprofit/government).

- Specifies the eligible project and scope.

- Allocates the deduction to the architect, engineer, or contractor.

This creates a win-win: nonprofits and schools benefit from efficient buildings, and designers gain valuable tax deductions for their work.

Key Deadlines to Remember

Here’s the simple timeline you need to keep in mind:

What You Should Do Now

If you’re a business owner, contractor, or nonprofit leader:

- Identify potential projects: Lighting, HVAC, building envelopes, or full new construction.

- Move quickly: Make sure projects begin construction before June 30, 2026.

- Prioritize service date: Complete projects by December 31, 2026 to lock in the easier ASHRAE 2007 baseline.

- Document PWA compliance: To secure the full deduction.

- Set up allocation agreements: For nonprofits and municipalities, plan now to allocate the deduction to eligible designers.

- Engage a consultant: 179D is powerful, but compliance and documentation are complex.

Conclusion: The Window Is Narrow

Section 179D remains one of the most powerful financial tools for energy-efficient buildings. But under OBBBA, the program is winding down fast.

- For most projects, 2026 is the last real window to qualify easily under ASHRAE 2007.

- After that, stricter standards and termination of eligibility for new projects will sharply reduce the benefit.

- Nearly every project with LED upgrades or basic efficiency measures can qualify if completed by 2026.

Regenerative Shift helps businesses, schools, and nonprofits navigate the details of 179D, document compliance, and secure the maximum deduction. If you’re considering a project—even one in early planning—now is the time to act.