Table of Contents

ToggleUpdated: 7/12/25

By: Caleb Quaid

Executive Summary

- Residential Solar Credit Ends in 2025: Homeowners can no longer claim the 30% federal solar tax credit (Section 25D) for purchases after 2025, whereas previously this credit was scheduled to last into the 2030s. Home solar systems must be paid for by December 31, 2025, to qualify under the old rules.

- Leased Residential Systems Still Qualify: Solar residential installations under leases or power purchase agreements (third-party owned systems) will continue to earn a commercial tax credit (Section 48E) for the provider. The bill preserves credits for leased rooftop solar PV, though it comes with new restrictions and phase outs. This shifts the residential market toward third-party ownership after 2025 until the credit expires on December 31, 2027.

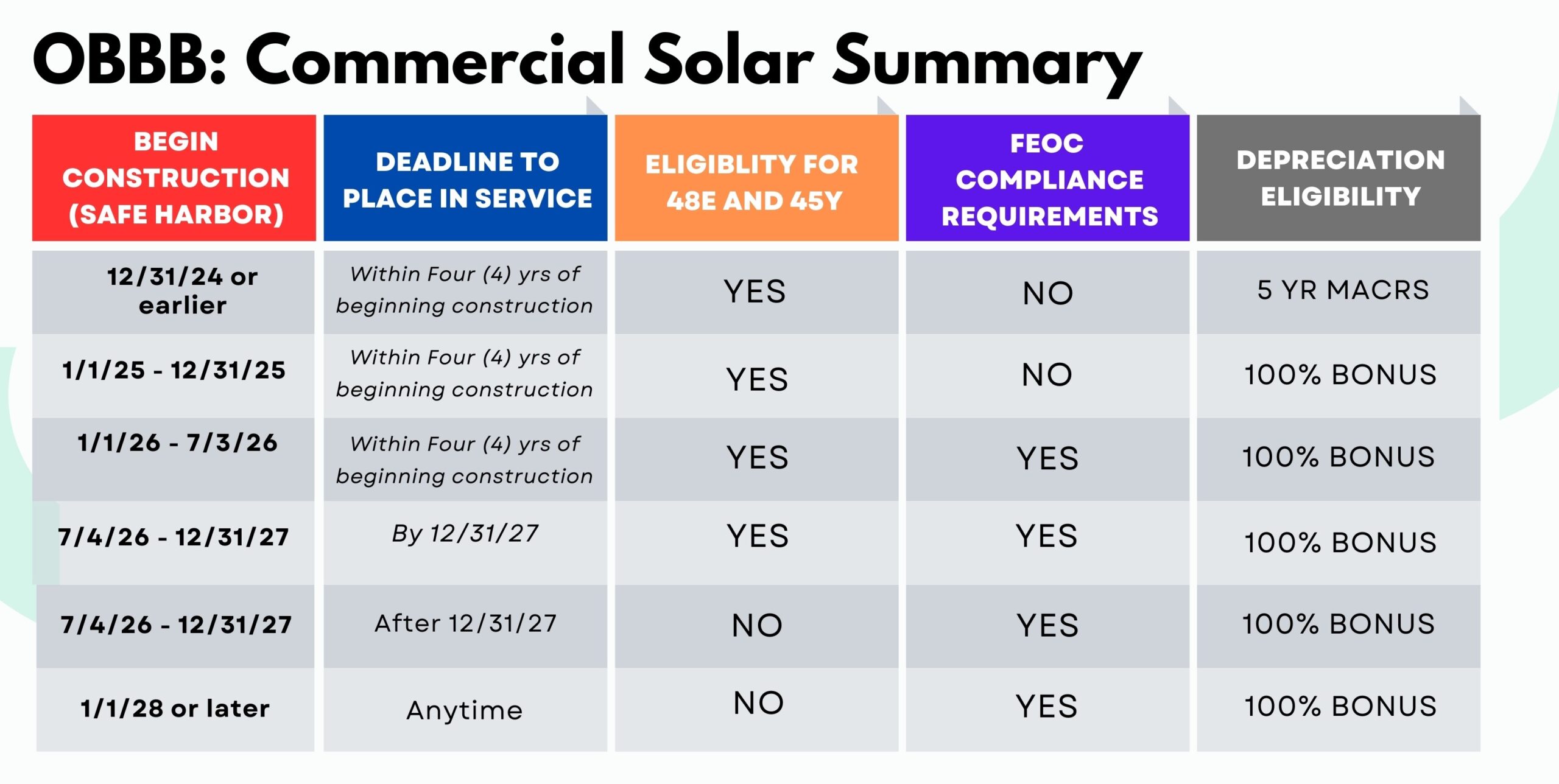

- New Deadlines for Commercial Projects: For commercial and utility-scale solar, the Investment Tax Credit (ITC) under Section 48E remains at 30% (plus bonus credits) but with strict timing rules. Projects that begin construction by July 3, 2026 keep the standard timeline (generally four years to complete), while projects starting after that date must be placed in service by December 31, 2027 to qualify. Essentially, no new solar projects will receive federal ITC or Production Tax Credits after 2027 under the new law.

- Safe Harbor Rules and Guidance: The bill codifies existing IRS safe harbor provisions for beginning construction – developers can either start significant physical work or incur at least 5% of project costs to lock in a tax credit. However, a July , 2025 White House Executive Order directed the Treasury to tighten these rules so it is likely that stricter Safe Harbor requirements are imminent.

- Additional Restrictions and Implications: The law introduces “prohibited foreign entity” rules starting in 2026 – solar projects will lose tax credits if too much of the equipment comes from certain foreign-owned companies (e.g. Chinese-controlled suppliers). It also eliminates accelerated depreciation benefits for new solar projects (no more five-year rapid depreciation for systems begun after 2024). These changes mean developers, contractors, homeowners, and financiers must act quickly, adjust strategies, and document projects carefully to secure remaining incentives.

Introduction

On July 4, 2025, sweeping legislation nicknamed the “Big, Beautiful Bill” was signed into law. Officially titled the One Big Beautiful Bill Act (H.R. 1, Public Law 119-21), this law makes significant changes to federal tax policy, including a major impact on solar energy incentives. The bill accelerates the phase-out of clean energy tax credits that were expanded under 2022’s Inflation Reduction Act. In neutral terms, it fast-tracks the sunset of some solar tax credits and imposes new requirements, while still preserving certain benefits under specific conditions. This article provides an accessible overview of what’s changed and what it means for anyone involved with solar projects – from homeowners and contractors to large-scale developers and financing partners.

Under the previous rules (the IRA framework), homeowners could claim a 30% Residential Clean Energy Credit (Section 25D) for installing solar panels or other clean energy equipment, and this was set to remain in place at 30% through 2032 (then step down to 26% in 2033 and 22% in 2034). Likewise, businesses investing in solar were eligible for a 30% Investment Tax Credit – with the IRA transitioning to new technology-neutral credits (Section 48E for investment credits and Section 45Y for production credits) available well into the 2030s. The One Big Beautiful Bill Act (OBBB) changes course by ending or phasing out these credits much sooner. It also adds new rules to limit benefits for projects involving certain foreign-owned suppliers.

In the sections below, we break down the key provisions of the final bill that affect solar tax credits – for residential installations, commercial/utility projects, and third-party owned systems – and explain how these differ from the prior law. We’ll also discuss important deadlines, safe harbor rules, and phase-outs, as well as the implications for various stakeholders planning solar investments.

End of the Homeowner Solar Tax Credit (Section 25D)

One of the most notable changes is the early termination of the residential solar tax credit. Homeowners have until the end of 2025 to take advantage of the 30% federal tax credit for purchasing a solar energy system for their home. Expenditures made after December 31, 2025 will no longer qualify for this credit.

How does this compare to previous law? Under the IRA, the residential credit (Section 25D) was slated to remain at 30% through 2032 before gradually phasing down. The new law cuts that timeline short by roughly seven years. It effectively creates an end-of-2025 deadline for homeowners who want to own their solar systems and receive the tax credit. This urgency means 2025 is expected to be a very busy year for residential solar purchases, as installers and homeowners rush to start projects in time to qualify for the credit.

Leased Residential Systems: Importantly, the bill did not eliminate incentives for residential solar altogether. If a homeowner chooses to lease their solar panels or enter a power purchase agreement (PPA) with a solar provider (often called third-party ownership or TPO), the solar company can still claim a tax credit on the system under the commercial provisions (Section 48E). Early proposals had considered barring credits for leased rooftop solar units, but the final law allows them. This means after 2025, the primary way for homeowners to indirectly benefit from federal incentives will be through third-party owned solar, where the installer/developer claims the credit and typically passes on savings via lower monthly payments. We may see the residential solar market shift toward leases as a result.

The main takeaway for homeowners is that if you want to own your solar panels outright and get the 30% tax credit, 2025 is the deadline. After that, going solar will likely involve partnering with a lease/PPA provider who can use the Section 48E commercial credit.

Commercial & Utility Solar (Section 48E)

New Deadlines and Phase-Out

For commercial, industrial, and utility-scale solar projects, the Investment Tax Credit remains available via Section 48E (the tech-neutral clean electricity credit). However, the OBBB introduces hard stop dates and requirements that didn’t exist before. Here are the key changes:

- Construction Start Deadline: To secure a full 30% ITC under Section 48E, a solar project must begin construction by July 4, 2026. “Begin construction” can be satisfied by either starting significant physical on-site work or by incurring at least 5% of project costs (more on safe harbor rules below). Projects that meet this start date can still follow the standard timeline – which generally allows up to four years from the start of construction to complete the project and place it in service under IRS guidance. In practice, this means a solar farm that breaks ground (or invests 5% in equipment) by mid-2026 could be finished as late as 2030 and still claim the tax credit under the old rules.

- Placed-in-Service Deadline: For any solar projects that start construction after July 4, 2026, the law imposes a strict cutoff – they must be placed in service by December 31, 2027 to get a tax credit. This effectively means that no new solar projects can begin after mid-2026 and still expect federal tax credits unless they are completed in 2027 or earlier.

- Impact on Project Pipeline: Developers and solar contractors will need to accelerate project timelines. Any planned solar farms or commercial installations should ideally be kicked off by the first half of 2026 at the latest. Projects that start later risk falling into the narrow 2027 completion window or losing eligibility altogether. This may front-load solar development into 2024–2026. Companies might also consider splitting projects into phases or breaking ground early (even if final installation happens later) to meet the “begin construction” safe harbor by the deadline.

Safe Harbor Provisions: Five Percent Rule & Continuous Progress

The concept of “Safe Harbor” for beginning construction has become crucial under these new timelines. The IRS had established guidelines (through Notices 2013-29, 2018-59, and others) to determine when a project is considered to have begun construction for tax credit purposes. Here’s a quick explanation of these provisions in plain language:

- Five Percent Rule: If a project developer pays at least 5% of the project’s total cost prior to the deadline (for example, by purchasing solar panels, inverters, or racking equipment that equals 5% of the project’s budget), the project is treated as having begun construction. This rule allows developers to “safe harbor” a project by investing some money up front – often ordering major components – by the cutoff date.

- Physical Work Test: Alternatively, a developer can start “physical work of a significant nature” at the site (or on customized equipment in a factory) before the deadline. This means doing real, measurable construction work on the project – for instance, excavation for foundations or installation of mounting structures. A token action like a single test trench may not qualify; it should be substantive work on project elements integral to the energy facility.

- Continuous Construction/Continuity Requirement: Both safe harbor methods come with an expectation of continuous progress. In practice, after you’ve met the 5% spend or begun physical work, you must continue making steady efforts to advance the project toward completion.

While the OBBB referenced existing Safe Harbor guidance, on July 7, 2025 President Trump an Executive Order that explicitly directs the Treasury to tighten Safe Harbors, “ensuring that policies concerning the beginning of construction are not circumvented… and restricting the use of broad safe harbors unless a substantial portion of a facility has been built.” In plainer terms, the government wants to crack down on projects that technically met the 5% rule (say, by buying some equipment) but then stalled for years. Going forward, we anticipate stricter enforcement – projects will need to show real activity and momentum.. Developers should document construction milestones and maintain a steady schedule to satisfy these safe harbor rules.

For solar contractors and developers, the safe harbor provisions are a double-edged sword: they offer a way to lock in the current tax credit before deadlines hit, but they also require careful planning and execution. Companies may choose to pre-purchase equipment in bulk (5% rule) by end of 2025 or 2026 for projects to secure the credit, which could keep them busy well beyond 2027 under the four-year completion allowance. At the same time, firms must be ready for potential new IRS guidance tightening what counts as begun construction. In short, safe harbor is now practically essential for any project aiming to utilize tax credits before they expire, and maintaining continuous progress will be key to actually realizing those credits.

Foreign Entity Restrictions (FEOC Rules)

Another major change in the law is the introduction of restrictions on projects involving “prohibited foreign entities,” often referred to as foreign entities of concern (FEOC). This reflects a policy aim to reduce reliance on certain foreign (especially Chinese) suppliers in the clean energy supply chain. Here’s what solar developers and contractors need to know:

- Starting in 2026, solar projects will only qualify for the ITC or PTC if they meet new domestic/ally content thresholds. Specifically, for projects beginning construction in 2026, at least 40% of the value of all manufactured products used must come from manufacturers that are not prohibited foreign entities. In other words, if too much of your solar equipment is made by companies owned or controlled by China, your project could lose the tax credit.

- Impact: These FEOC rules mean that solar developers will need to audit their supply chains carefully. Modules, inverters, and batteries will have to be sourced in large part from U.S. or allied-country manufacturers to ensure compliance.

- Note that these restrictions apply to projects starting in 2026 or later. Thus, one way to avoid the complexity is to Safe Harbor projects by the end of 2025. Projects that begin before 2026 are not subject to the foreign entity material rule for their credits. This creates yet another incentive to accelerate projects starting before the new year 2026. Otherwise, from 2026 onward, compliance with the threshold will be necessary to claim credits.

For financing partners and investors, the FEOC rules add a layer of risk to manage – tax equity investors will require assurances that projects meet the domestic content percentages, or else the credits (and their return on investment) vanish. This likely means more due diligence on procurement and possibly contracts including representations or warranties about equipment sourcing.

Changes to Accelerated and Bonus Depreciation

In addition to credit changes, the OBBB alters how solar projects can claim depreciation. Historically, commercial solar installations benefited from accelerated depreciation (Modified Accelerated Cost Recovery System, MACRS), typically a 5-year schedule, which allowed a faster write-off of project costs for tax purposes. Many solar developers also enjoyed 100% bonus depreciation (full expensing) in recent years, which was phasing down under prior law. These depreciation benefits, when combined with tax credits, significantly improved solar project economics by reducing taxable income in early years.

The new law makes the following changes:

- No more 5-Year MACRS for new projects: The special 5-year classification for solar (and wind) energy property is terminated for any project that begins construction after December 31, 2024. In plain terms, this means future solar projects will not automatically qualify as 5-year property. Without this provision, solar assets would fall into longer depreciation classes (potentially 20-year or even 39-year property, like other utility equipment). This is a notable shift, essentially removing a tax incentive that has been in place for decades to promote renewables. It could reduce the tax shelter benefits of solar investments going forward.

- Bonus Depreciation Restored: At the same time, the OBBB Act permanently reinstates 100% bonus depreciation for qualified property acquired after January 19, 2025. This means businesses can immediately deduct the entire cost of new equipment in the first year it’s placed in service, rather than depreciating over many years. Solar equipment should qualify under this rule, so in effect, a project placed in service in 2025 or 2026 can still get a full immediate write-off of capital costs. In the short term, this softens the blow of losing 5-year MACRS – because full expensing is even faster. However, bonus depreciation is subject to general tax policy changes and is not specifically a solar incentive. (It had been scheduled to phase down under previous law, hitting 0% by 2027, but the new bill halts that phase-down and keeps it at 100% going forward.)

- Implications: The current law’s reinstatement of full expensing in 2025 does provide a significant upfront tax benefit, encouraging investment in the near term. Owners of projects should also consult tax advisors on how the interplay of no MACRS vs. bonus depreciation will work for their specific situation. Overall, while the tax credits are phasing out, some general business tax breaks (like expensing) have been broadened – a shift in policy focus from favoring specific clean energy perks to favoring capital investment in general.

What These Changes Mean for You

Homeowners

If you’re a homeowner considering solar, the message is clear – 2025 is the last chance to directly benefit from the federal 30% tax credit for owning your system. Ensure your contract and payments are in place by the end of 2025. After that, you can still go solar, but likely through a lease or PPA, where a company installs panels on your roof at little or no upfront cost and you pay for the power. The upside of a lease is you avoid the large initial expense; the downside is you won’t get the tax credit yourself (it goes to the company).

Residential Solar Installers

Residential solar contractors should brace for a shift in business models. In the next year or two, expect a rush of customers seeking installs before the credit expires. You may need to scale up capacity in 2024–25 and manage customer expectations about timelines (making sure projects are substantially paid by end of 2025). Post-2025, consider partnering with third-party finance providers if you haven’t already, so you can offer leasing options to customers – this will likely become a larger portion of the market.

Commercial Solar Installers

The focus will be on timing and documentation: work closely with developers to initiate projects by the safe harbor deadlines, and keep meticulous records of when construction starts. Engineering, procurement, and construction teams will need to coordinate to meet the 5% procurement thresholds or begin physical work in time. Additionally, contractors should start vetting their supply chain for compliance with the new foreign entity rules. Ensure key components (modules, inverters) are sourced from approved manufacturers, and communicate with developers about any potential cost implications or delays in obtaining compliant equipment. In summary, speed and supply chain savvy will be essential for contractors moving forward.

Project Developers

Utility-scale and commercial solar developers face strategic and logistical challenges. Pipeline planning is now on a tight schedule – projects in development should either be fast-tracked to start by mid-2026 or risk losing federal support. This might mean prioritizing advanced-ready projects and pausing very early-stage projects that can’t meet the window. Safe harbor strategies (like buying modules in advance) will become a standard practice to secure tax credit eligibility; however, that ties up capital and carries the risk of changing rules, so plan financing accordingly. The elimination of accelerated MACRS depreciation for post-2024 projects (barring the bonus depreciation effect) could slightly reduce project returns, which you’ll need to account for in financial models. Perhaps the most complex new factor is the FEOC supply chain requirement – developers will need to navigate securing panels and batteries that meet the increasing domestic/friendly content thresholds. This might involve building relationships with domestic manufacturers or even reshuffling project locations and designs to utilize equipment that qualifies. In some cases, developers might opt to safe harbor equipment before 2026 (thereby avoiding the restriction) if they foresee supply issues. Expect intense competition for compliant hardware as the thresholds rise.

Financing Partners (Investors/Lenders/Tax Equity)

Investors will see a changing landscape. The volume of deals may swell in the next couple of years as sponsors rush to start projects that still qualify for credits. After 2027, the traditional solar tax equity market could contract significantly since the federal credits drop off – except perhaps for projects safe-harbored in time. In the interim, diligence is key: investors must verify that projects they finance truly began construction in time and are on track to meet placed-in-service deadlines. This includes reviewing safe harbor documentation (invoices, work logs) and monitoring construction progress to ensure compliance with the continuous work requirement. The foreign entity content rules add another layer of risk to underwrite – tax equity agreements might include covenants or certifications about equipment sourcing, and breach of those could mean loss of credits (hence losses for the investor). Some investors might demand higher returns or reserves to cover this risk. On the lending side, banks financing projects will also be concerned that a project stays on schedule and meets the criteria for the credit; loan terms may include milestones tied to these deadlines. The positive news for financiers is the reinstatement of 100% bonus depreciation – this can provide a significant upfront tax shield (improving early project cash flows or tax capacity for investors). All said, financing partners should work closely with sponsors to navigate this transition period, adapt to new compliance requirements, and explore alternative incentives (like state credits, renewable energy certificates, or emerging programs) to fill the gap in project economics once the federal credits wind down.

Conclusion

The One Big Beautiful Bill Act marks a turning point for the solar industry’s federal support. The law’s provisions are neutral in wording but have clear effects: they accelerate the phase-out of tax credits that have spurred solar adoption, and they add new hurdles intended to ensure projects are genuinely advancing and relying on non-adversarial supply chains. For a general business owner or homeowner, the takeaway is that federal incentives for solar are on a faster ticking clock – but those who act quickly can still capture substantial tax benefits. For industry professionals, it’s time to adjust strategies: emphasize near-term project development, tighten project management to meet deadlines, and shore up supply chains and partnerships.

While the tone of this legislation is less supportive of renewable energy than the previous status quo, solar remains a compelling option for many due to long-term energy savings, state/local incentives, and continued declines in technology cost. There may also be opportunities in the bill’s other provisions (for example, the push for domestic manufacturing and

expedited permitting for energy projects) that could benefit segments of the solar value chain.

In navigating these changes, it’s crucial to stay informed through official guidance. As always, consider consulting with tax professionals or legal experts for project-specific advice – the complexity of these changes means the details matter in order to fully benefit from (or simply qualify for) the remaining incentives.